How to Calculate Creditors Turnover Ratio

Creditor Days Ratio Trade CreditorsCost of Sales365 You might be wondering what the difference between these two formulas is. Creditors Payable Turnover Ratio or Creditors Velocity Net Credit Annual Purchases Average Trade Creditors.

Accounts Payable Turnover Ratio Definition Formula Free Template

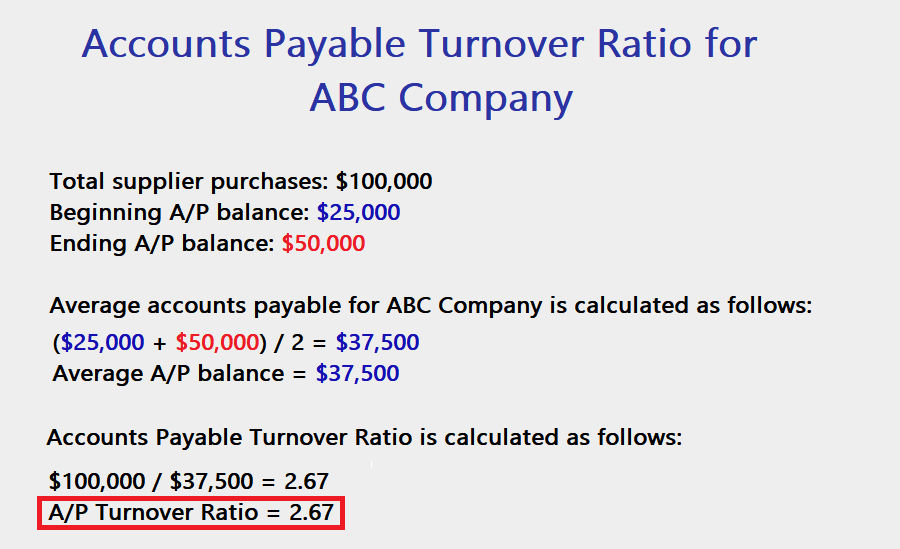

50000 1000002.

. Accounts receivable turnover ratio Net credit sales Average accounts receivable. Trade Creditors Sundry Creditors Bills Payable. AP Accounts payable TSP Total supply purchases BAP Beginning accounts payable EAP Ending accounts payable beginaligned textAP Turnover.

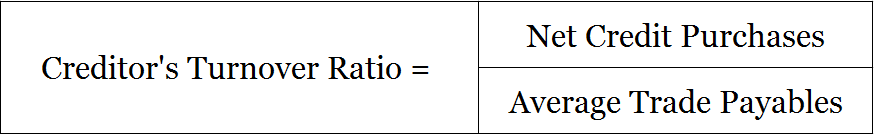

It shows that the inventory turnover ratio is 3 times and it should be compared to the previous years data as well as other players in the industry to get a better sense. Formula to Calculate Creditors Turnover Ratio. Turnover ratios are the percentage of a portfolios equities that a firm replenished in a fiscal period.

Receivables turnover ratio net sales on credit average receivables This value indicates the companys receivables turnover ratio is 68 so for all sales on credit the company makes 68 of client payments arrive on time. Debtors Turnover Ratio Net Credit Sales Average Trade Debtors. Average Trade Creditors Opening Trade Creditors Closing Trade Creditors 2.

AP Turnover TSP BAP EAP 2 where. Creditors turn over ratio Net credit purchase Average accounts payable 5 times. Same as debtors turnover ratio creditors turnover ratio can be calculated in two forms.

Debtors Turnover Ratio Formula. Total supplier purchases Beginning accounts payable Ending accounts payable 2. The trade debtors for the purpose of this ratio include the amount of Trade Debtors Bills Receivables.

February 26 2022 One way to calculate a creditors turnover ratio is to divide the annual net credit transactions by the average accounts payable. The following formula is used to calculate creditors payable turnover ratio. The accounts receivable turnover ratio formula is as follows.

To calculate the Accounts Receivable Turnover divide the net value of credit sales during a given period by the average accounts receivable during the same period. Ie 54200 5800 60000. Debtors Turnover ratio fracCredit SalesDebtors Bills Receivable And with a slight modification we also derive the average collection period.

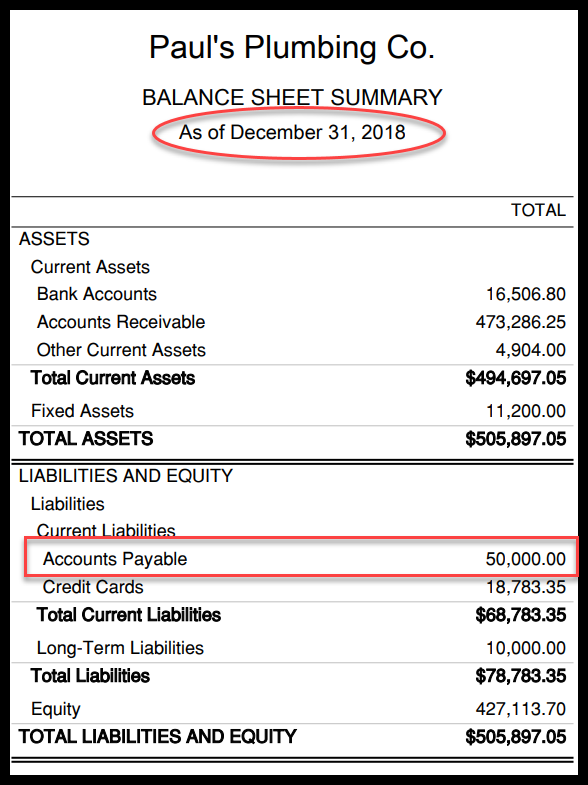

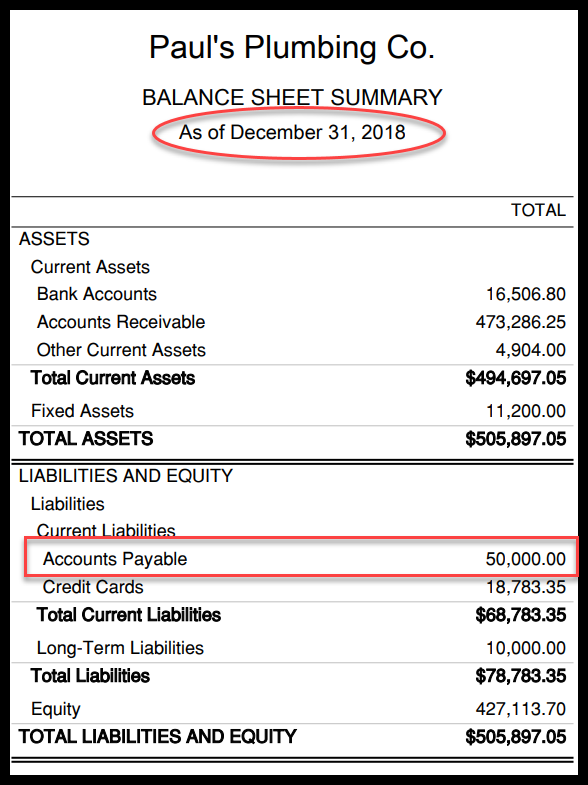

To determine your receivables turnover ratio you simply divide your net credit sales from step 1 by your average accounts receivable from step 2. The accounts payable turnover in days shows the average number of days that a payable remains unpaid. The two basic components of accounts receivable turnover ratio are net credit annual sales and average trade debtors.

An average for your accounts receivable can be calculated by adding the value of the accounts receivable at the beginning and end of the accounting period and dividing it by two. Accounts payable turnover in days 365 Accounts payable turnover ratio. For some companies and organizations this can be the calendar year or any other 12-month period that denotes the fiscal year.

The total purchases number is usually not readily available on any general purpose financial statement. You should include credit purchases within the cost of sales. 500000 200000.

Net Credit Purchases COGS Ending Inventory SI where. Accounts payable turnover ratio also known as creditors turnover ratio or creditors velocity is computed by dividing the net credit purchases by average accounts payable. Accounts Receivable Turnover Ratio Net Credit Sales Average Accounts Receivable.

The formula for Accounts. Accounts Receivable Turnover Ratio Formula. Inventory Turnover Ratio Cost of Goods Sold Average Inventory.

Like receivables turnover ratio it is expressed in times. The analysis for creditors turnover is basically the same as of debtors turnover ratio except that in place of trade debtors the trade creditors are taken as one of the components of the ratio and in place of average daily sales average daily purchases are taken as the other component of the ratio. A simple example of a turnover rate may be a company that buys 800 stocks and replaces 600 of them.

Average Trade Receivables Opening Trade Receivables Closing Trade Receivables2. Creditors turnover ratio is also known as Payables Turnover Ratio Creditors Velocity and. To calculate the accounts receivable turnover ratio you need to first calculate the net sales and average accounts receivable.

Net Credit Sales 300000. Debtors Turnover ratio fracCredit SalesAverage Debtors OR. High and Low Creditors Turnover Ratio.

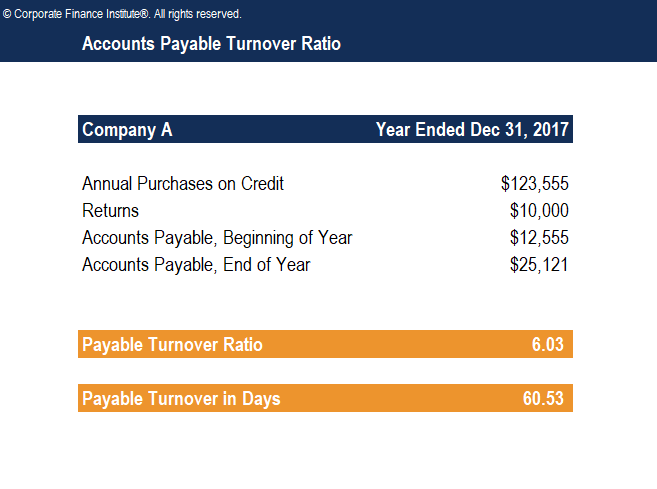

Inventory Turnover Ratio 3 Times. Average age of creditors Average account payable x Days of year Net credit purchases 73 days. Payable Turnover in Days 365 Payable Turnover Ratio.

To calculate the accounts payable turnover in days simply divide 365 days by the payable turnover ratio. How to Calculate the Accounts Payable Turnover Ratio. Debtors turnover ratio or Accounts receivable turnover ratio Net Credit SalesAverage Trade Receivables Net Credit Sales Total Sales Cash Sales.

It measures the number of times on average the accounts payable are paid during a period. Inventory Turnover Ratio 12000 4000. Net credit sales Credit Sales Credit sales refer to a sale in which the amount owed will be paid at a later date.

COGS Cost of goods sold SI Starting inventory beginaligned textNet Credit Purchases textCOGS. Accounts payable turnover in days 365. Creditors Turnover Ratio or Payables Turnover Ratio.

Example Payables Turnover Ratio. The following is an example of how to calculate the accounts receivable ratio. To calculate the accounts payable turnover ratio summarize all purchases from suppliers during the measurement period and divide by the average amount of accounts payable during that period.

Determining the accounts payable turnover in days for Company A in the example above. This will indicate the average number of daysweeksmonths in which the payment from the debtor is collected by a firm. The accounts receivable turnover ratio formula looks like this.

As opening creditors are not given so average creditors will be considered as ending creditors Ending bills payable. Using our example from above.

Accounts Payable Turnover Ratio Formula Example Interpretation

Accounts Payable Turnover Ratio Definition Formula Free Template

Comments

Post a Comment